Moving to France as an American means discovering new food, new culture, and—yes—new bureaucracy. One of the first challenges is opening a bank account [compte bancaire]. Without it, you can’t rent an apartment [appartement], set up your utilities [factures], or even receive your salary [salaire].

When you walk into a bank branch [agence bancaire], you’ll meet a bank advisor [conseiller bancaire] who will ask for documents, often in fast French. Don’t panic. This guide walks you step by step through the French banking maze, with clear explanations, cultural differences, and essential vocabulary in brackets.

What Documents Do You Need to Open a Bank Account in France?

Here lies a paradox many expats call the chicken and egg [l’œuf et la poule] problem. To open a bank account [compte bancaire], the bank will ask for a proof of address [justificatif de domicile]. But to rent an apartment [appartement] or sign a lease [contrat de location], landlords usually want proof that you already have a French bank account. Each side depends on the other, and newcomers often get stuck in this circle.

So, what should you prepare? A French bank will usually request:

- Passport [passeport] – your official ID.

- Proof of address [justificatif de domicile] – often a rental contract or a utility bill.

- Residency permit [titre de séjour] – if you are not on a tourist visa.

- Work contract [contrat de travail] or pay slips [fiches de paie] – to prove income.

- For Americans: the W-9 tax form [formulaire fiscal W-9], required under FATCA.

Once your file [dossier] is accepted, the bank gives you:

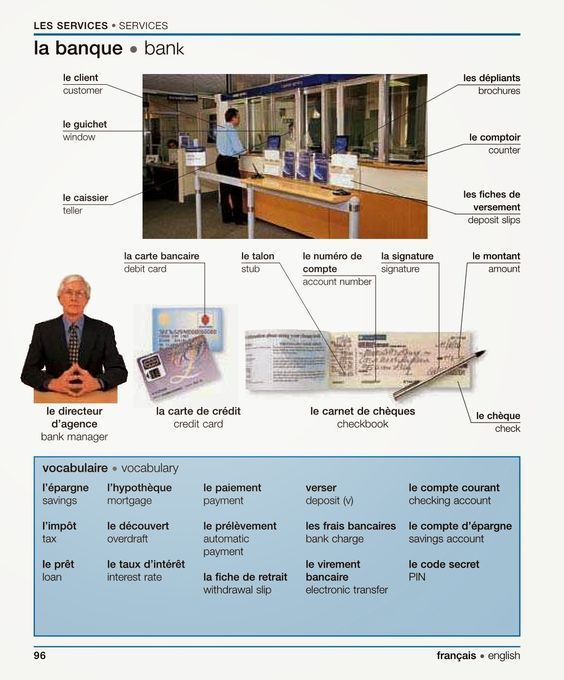

- a debit card [carte bancaire],

- and your bank identity slip [RIB – Relevé d’Identité Bancaire], the key document for setting up payments and receiving income.

Phrase to practice:

- Quels documents faut-il pour ouvrir un compte ? → What documents are needed to open an account?

Which Banks in France Work Best for American Expats?

Not all banks in France treat U.S. citizens the same. Because of FATCA (U.S. tax law), some online banks [banques en ligne] like Boursorama or Fortuneo are quick to reject American clients. In forums, expats often report getting their applications canceled once the bank sees a U.S. passport.

That’s why many Americans choose traditional banks with a larger presence:

- BNP Paribas → international, partnered with Bank of America. Good for transfers.

- Société Générale → strong in cities, some English-speaking staff.

- Crédit Agricole → very regional. Sometimes stricter, sometimes more flexible, depending on the local branch [agence bancaire].

- Crédit Mutuel / CIC → cooperative banks, often welcoming to expats.

- La Banque Postale → everywhere in France (inside post offices), but slower and less modern.

- HSBC France → international, familiar with U.S. clients, but with higher fees.

- Boursorama / Fortuneo (online banks) → low fees, but many Americans are rejected due to FATCA.

- Revolut / N26 (neobanks) → quick setup, English-language apps, perfect for travel. But they are not always considered “full French banks,” which can be a problem for things like prélèvements automatiques (direct debits) or landlord requirements.

Teacher’s tip: if one branch says “no,” try another. French banks are local, and one branch [agence] may be stricter than the next.

How the Banque de France Can Help If You’re Refused

If your bank advisor [conseiller bancaire] refuses your application, ask politely for a refusal letter [lettre de refus]. With this document, you can go to the Banque de France and exercise your right to an account [droit au compte].

By law, the Banque de France must assign you a bank that will open at least a basic account for you. It may not be your first choice, but it will allow you to pay rent [loyer], receive your salary [salaire], and manage daily life.

Phrase to practice:

- Puis-je avoir une lettre de refus ? → May I have a refusal letter?

What Is a RIB and the French Bank Key?

Every time you open a bank account in France, you receive a RIB [Relevé d’Identité Bancaire]. This document contains your:

- Bank code [code banque]

- Branch code [code guichet]

- Account number [numéro de compte]

- Key [clé RIB] – a two-digit number that validates your account.

You’ll use your RIB for almost everything: setting up automatic debits [prélèvements automatiques], receiving your salary [salaire], or paying your rent [loyer].

Phrase to practice:

- Je peux avoir un RIB, s’il vous plaît ? → Can I have a RIB, please?

Dialogue à trous – Practice Before You Go to the Bank in France

Here’s a classic gap-fill exercise you can practice:

Conseiller : Bonjour Madame, vous voulez ____ un compte ?

a) fermer b) payer c) ouvrir

Client : Oui, je viens d’arriver ____ France.

a) au b) en c) à

Conseiller : Très bien. Vous avez ____ passeport ?

a) le b) vos c) votre

Client : Oui, et faut-il aussi ____ justificatif de domicile ?

a) une b) des c) un

Conseiller : Exactement. Nous allons préparer votre ____

a) dossier b) papier c) cas

Client : Merci beaucoup !

Correction with Translation

- ouvrir un compte → open an account

- en France → in France

- votre passeport → your passport

- un justificatif de domicile → a proof of address

- dossier → file

Essential French Vocabulary for the Banque

| French word | English meaning | Example |

|---|---|---|

| ouvrir un compte | open an account | Je voudrais ouvrir un compte. → I’d like to open an account. |

| fermer un compte | close an account | Je veux fermer mon compte. → I want to close my account. |

| carte bancaire | debit card | J’ai perdu ma carte bancaire. → I lost my debit card. |

| RIB | bank identity slip | Je vous envoie mon RIB. → I’m sending you my RIB. |

| faire un virement | make a transfer | Je voudrais faire un virement. → I’d like to make a transfer. |

| prélèvement automatique | direct debit | Le loyer est payé par prélèvement automatique. → Rent is paid by direct debit. |

| découvert autorisé | authorized overdraft | Est-ce que j’ai droit à un découvert autorisé ? → Am I entitled to an overdraft? |

| frais bancaires | bank fees | Quels sont vos frais bancaires ? → What are your bank fees? |

| agence bancaire | bank branch | Où est l’agence bancaire la plus proche ? → Where is the nearest bank branch? |

Key Differences Between U.S. and French Banking

- Fees [frais]: In the U.S., many checking accounts are free. In France, monthly fees are standard, even for basic accounts.

- Overdrafts [découverts]: In the U.S., overdraft protection is automatic. In France, you must negotiate an authorized overdraft [découvert autorisé].

- Cards [cartes]: U.S. banks often issue credit cards first. In France, your carte bancaire is a debit card linked directly to your balance.

- Checks [chèques]: Still used in France for rent or security deposits, while nearly extinct in the U.S.

- Account opening: In the U.S., it can take 15 minutes online. In France, expect appointments, paperwork, and even weeks before you receive your carte bancaire.

Can You Live in France Without a Bank Account?

It is possible to survive for a while in France without a French bank account [compte bancaire] if you rent a furnished apartment [appartement meublé] where the landlord includes and pays the utilities [factures], or if your landlord accepts international transfers from your U.S. bank. Some expats also rely on fintech apps like Revolut or Wise to get a European IBAN [IBAN européen] for payments. But in the long term, life becomes difficult: employers require a French RIB [Relevé d’Identité Bancaire] to pay your salary [salaire], government agencies like CAF or CPAM only reimburse into French accounts, and many landlords or providers insist on direct debit [prélèvement automatique]. So while you may “get by” at first without a French bank account, opening one is ultimately the key to stability in daily life.

Final Tips Before You Go to the Bank in France

For Americans, French banking is not just about signing forms. It’s about adapting to a different rhythm, understanding the rules, and practicing the language.

- Bring all your documents [papiers] — more than you think you’ll need.

- Prepare simple French sentences: Je voudrais ouvrir un compte (I’d like to open an account).

- Be patient with delays. French banks move slower than U.S. ones.

- If refused, use your right to an account [droit au compte] via Banque de France.

When you finally hold your RIB in your hands, you’ll know you’ve passed a milestone. Going to the bank in France isn’t just bureaucracy — it’s also your first real-life French lesson.

Sign Up for the Feel Good French Newsletter

What happens on the 2nd of February in France?

February 2nd in France sits in the Carnival season. Americans know Mardi Gras. This is…

She Didn’t Just Move to Provence. She Learned to Belong.

Interview with Carolyne Kauser-Abbott, Founder of Perfectly Provence Some people fall in love with Provence…

Beyond Strasbourg & Colmar: 5 Unexpected French Christmas Markets to Visit in 2025

December in France is more than a season. It is an atmosphere (une ambiance). A…

Moving to Fontainebleau: The Real Story of Janice in France

When Janice Deerwester says “Bonjour!” on her YouTube channel, her Texas accent still peeks through….

Go to the Bank in France: The American Expat’s Guide to French Banking

Moving to France as an American means discovering new food, new culture, and—yes—new bureaucracy. One…

French Clothing Sizes in US: A Clear Guide for American Expats

Your first weeks in France are a string of small delights and quick puzzles. The…